Central banks of the world’s leading economies have been dealing with inflationary pressures. As a result, we see the policy of driving up interest rates in various countries, with the Federal Reserve in the USA being the primary example.

We see that this policy of tighter money will not significantly reduce the current inflation. On the contrary, tighter money, especially the more expensive US dollar, is likely to result in higher inflation across the world economy.

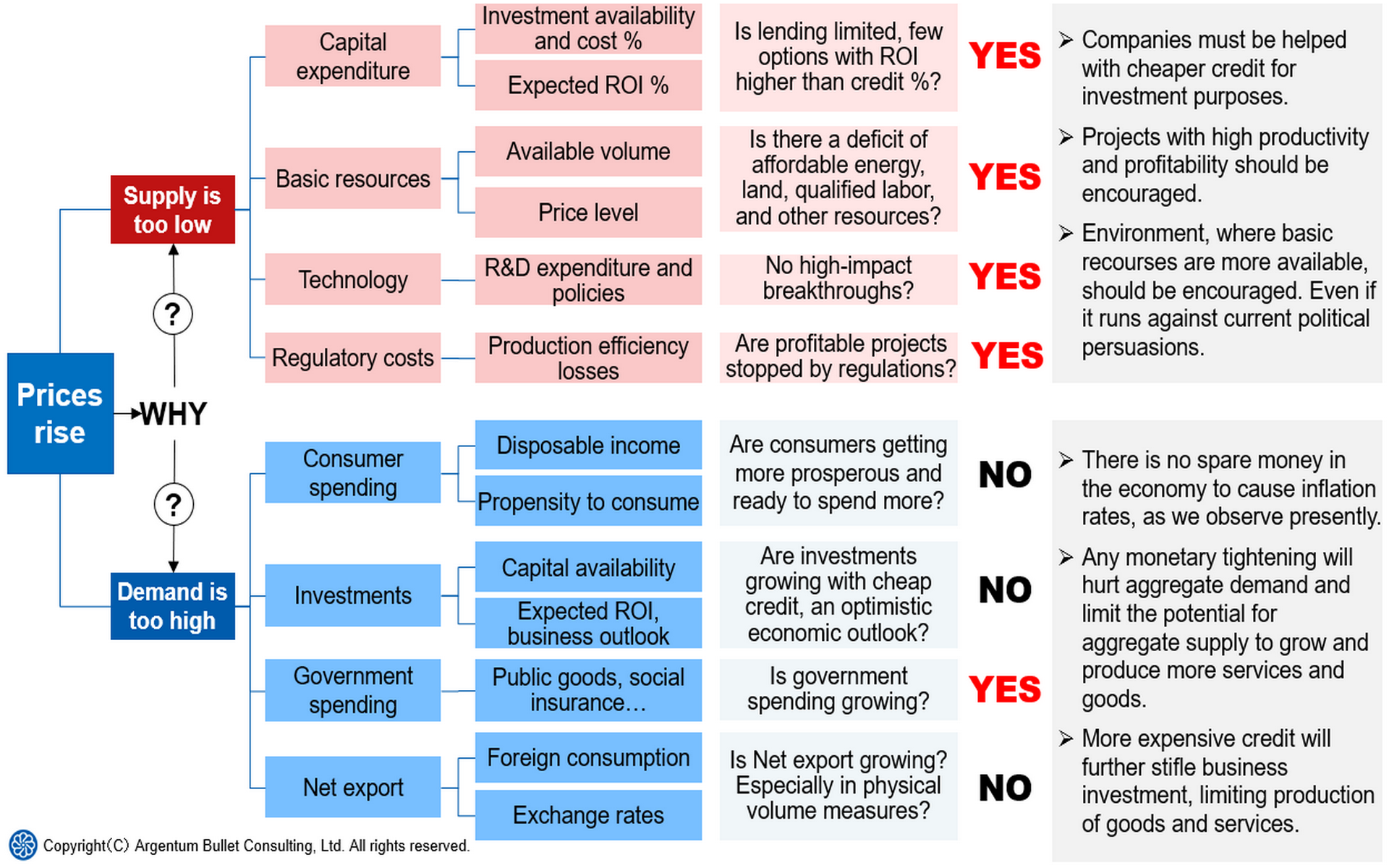

Why so? The main reason is that the current inflation’s underlying causes are not on the demand side but on the supply side. Currently, the prevalent thought is that inflation is triggered by too much money and too big demand in the economy, which causes the disbalance between money vs. available goods and services, and causes rising prices for these goods and services. Hence the reaction to tighten up the money supply in an effort to bring down inflation. However, the inflationary trigger can occur on the supply side as well. If there is a supply shock that reduces the production of goods and services, the prices will rise, and inflation will occur.

So, while we see some monetary (demand) factors contributing to inflationary pressure, such as growing government spending, we consider production (supply) factors to be significantly more important. We do not observe excess money being held by the majority of the households. On the contrary, we observe a fall in income for the majority of the population, especially disposable income. Likewise, we do not observe any wide-scale investment booms or net export growth.

On the other hand, we see that profitability levels of existing production (investment) are not growing, if not outright falling. That means that if there is no access to cheap capital sources, investments are not made, and production is not maintained (increased). We also see that basic resources (energy, land, labor, basic crops, etc.) are getting more expensive due to many limiting factors. One of the limiting factors is the lack of major technological breakthroughs. There is a lot of innovation in services, IT, etc., but not in the producing industries. Another major limiting factor is regulatory and other political interference by the governments. Imposition of certain conditions on the economy due to political considerations results, for example, in more expensive energy. The prime example would be the premature, government-sponsored introduction of solar and wind generation in EU countries. These technologies are not yet ready to pick up the load that was borne by other types of generation. However, “green parties” pushed this policy through due to their political stance. The result is an unstable and expensive energy supply for the economy, bringing very negative consequences in terms of inflation too.

So, what should have been done to fight current inflation? We hope to expand on the topic in other posts. Here we would like to mention that every effort must be made to support production, producing industries. One thing that has to be done is the provision of affordable credit and capital sources. To that end, central banks need to keep a reasonably easy monetary policy. If credit is made more expensive, on top of all the other pressures on the producing sector of the economy, the supply is likely to shrink even more, the money-goods and services disbalance is likely to grow even further, and prices will grow accordingly. Hence, higher interest rates will cause even higher inflation.